Table of Contents

ToggleHDFC Securities: A Simple Guide to What It Offers

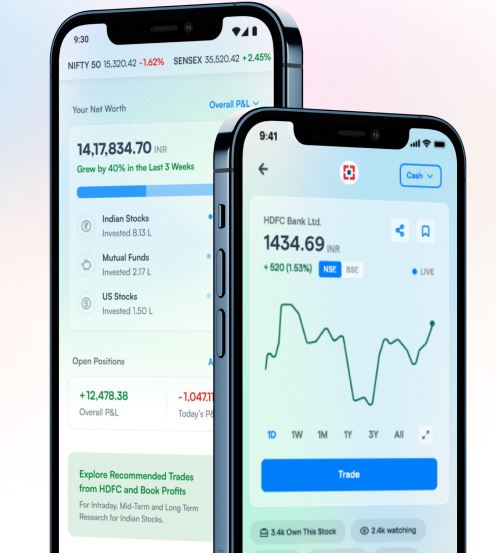

With a solid reputation backed by HDFC Bank, one of India’s most reliable financial institutions, HDFC Securities has earned the trust of over 4 million users.

HDFC Securities makes investing easy and trustworthy. Backed by HDFC Bank, it’s a go-to choice for millions of Indians. Whether you’re new to trading or already experienced, the platform offers everything you need — from stocks and mutual funds to real-time updates and expert advice. It’s simple to use, packed with features, and completely secure, making it a smart option for managing all your investments in one place.

Table of Contents

Whether you’re on mobile, desktop, or prefer call & trade — HDFC Securities offers smooth, intuitive platforms that make trading effortless even for beginners.

Introduction: What is HDFC Securities?

If you’re into investing or even just curious about how stock trading works, chances are you’ve heard of HDFC Securities. It’s one of India’s top stockbroking companies and a part of HDFC Bank—a name most of us already trust with our savings.

In short, HDFC Securities helps people buy and sell stocks, invest in mutual funds, trade in currencies, and even purchase insurance—all under one roof.

From stocks, mutual funds, and bonds to F&O, currency trading, IPOs, and insurance — you can manage your entire investment portfolio under one roof.

Core Services

HDFC Securities offers quite a few investment options. Here are the most popular ones:

-

Stock Trading – Buy and sell shares listed on NSE and BSE.

-

Futures & Options – For those who like to play the markets a little more actively.

-

Mutual Funds – Start a SIP or invest in lump sums across a wide range of funds.

-

Fixed Deposits & Bonds – If you’re looking for steady returns.

-

Currency Trading – Yes, forex trading is available too.

-

Insurance & IPOs – Apply for upcoming IPOs or get yourself covered with insurance.

They’ve really made it easy for all types of investors to manage everything in one place.

Stay informed with live stock prices, instant alerts, and real-time notifications — helping you make faster, smarter decisions

How You Can Trade with HDFC Securities

No matter how tech-savvy you are, there’s a way for everyone to trade:

-

Website – Their online portal is clean and user-friendly.

-

Mobile App – Great for trading on the go.

-

Call & Trade – Prefer speaking to a person? You can call and place orders over the phone.

Who Uses HDFC Securities?

The platform is designed for a wide range of users:

-

Regular folks like you and me (retail investors)

-

High-net-worth individuals (HNIs)

-

Non-Resident Indians (NRIs)

-

Large institutions

No matter your background, HDFC Securities probably has something for you.

Smart Investment Advice & Research

This is where they really shine. If you’re not sure where to start or what to invest in, HDFC Securities provides:

-

Daily market updates

-

Expert analysis (technical and fundamental)

-

Stock recommendations

-

Portfolio health checks

Even if you’re a beginner, this guidance can help you feel confident with your money decisions.

Safe and Regulated

One of the best things about HDFC Securities? It’s fully regulated:

-

Registered with SEBI (India’s market watchdog)

-

Member of NSE and BSE, the top stock exchanges

That means your investments are in safe hands.

More You Might Like

Final Thoughts

Whether you’re just starting your investment journey or looking for a better platform, HDFC Securities

has the tools and features you need. It’s safe, easy to use, and backed by one of India’s biggest banks.