Bitcoin ETF the Future of Cryptocurrency

Learn how Bitcoin ETF is changing cryptocurrency investments. Understand its benefits, risks, and future in this simple guide.

Table of Contents

- What is Bitcoin ETF?

- How Does Bitcoin ETF Work?

- Why is Bitcoin ETF Important?

- Pros and Cons of Bitcoin ETF

- The Future of Bitcoin ETF

- Conclusion

1. What is Bitcoin ETF?

Bitcoin ETF (Exchange-Traded Fund) is a way for people to invest in Bitcoin without actually buying and storing Bitcoin themselves. Instead of holding Bitcoin directly, investors buy shares of a fund that tracks Bitcoin’s price. This makes it easier for people who are familiar with stock markets but not cryptocurrency.

A Bitcoin ETF (Exchange-Traded Fund) makes investing in Bitcoin as easy as buying stocks. Instead of dealing with crypto wallets or exchanges, investors can buy shares of a Bitcoin ETF through traditional stock markets. This opens the door for more people, including big institutions, to invest in Bitcoin without the hassle of direct ownership.

Bitcoin ETFs are game-changers because they bring trust, regulation, and mainstream adoption to the crypto world. They offer a safer and more accessible way to invest, reducing the risks of hacks or losing private keys. With big financial firms backing them, Bitcoin is becoming a serious part of the global financial system.

As more countries approve Bitcoin ETFs, demand for Bitcoin could rise, pushing its price higher. This marks a huge step toward making cryptocurrency a mainstream asset, transforming how people invest in digital money.

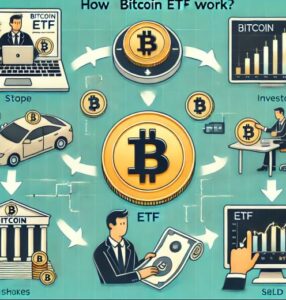

2. How Does Bitcoin ETF Work?

A Bitcoin ETF works just like a stock. It is listed on stock exchanges, and investors can buy or sell shares through their brokerage accounts. The fund itself holds Bitcoin or Bitcoin-related assets, and its value changes as Bitcoin’s price moves up or down. This allows traditional investors to get exposure to Bitcoin without dealing with crypto wallets or exchanges.

3. Why is Bitcoin ETF Important?

Bitcoin ETF is important because it makes Bitcoin investment more accessible to everyone. Many people want to invest in Bitcoin but find the process complicated. With Bitcoin ETF, they can invest through regular stock exchanges without worrying about security risks or handling private keys. It also brings more legitimacy to the crypto market because it follows financial regulations.

4. Pros and Cons of Bitcoin ETF

Pros:

- Easy to Buy and Sell – Bitcoin ETF is traded on stock exchanges, making it simple to invest.

- Regulated Investment – Since Bitcoin ETFs are managed by financial institutions, they offer more security.

- No Need for Crypto Wallets – Investors don’t have to worry about handling Bitcoin themselves.

- Diversification – Some Bitcoin ETFs include other assets, reducing overall risk.

- Better Tax Treatment – In some countries, ETFs have tax advantages compared to holding Bitcoin directly.

Cons:

- Fees – ETFs charge management fees, which can reduce returns.

- Price Tracking Issues – Sometimes, Bitcoin ETF prices do not match Bitcoin’s price exactly.

- Regulatory Risks – Governments might impose new rules that affect Bitcoin ETFs.

- Limited Control – Investors do not own actual Bitcoin, only shares of the ETF.

- Market Volatility – Since Bitcoin is volatile, the ETF price can fluctuate a lot.

5. The Future of Bitcoin ETF

Bitcoin ETFs are gaining popularity, and more financial institutions are starting to offer them. As regulations become clearer, we can expect more people and companies to invest in Bitcoin ETFs. Some experts believe that Bitcoin ETFs will help bring stability to the crypto market by attracting large institutional investors. However, challenges such as regulations and tracking accuracy still need to be addressed.

6. Conclusion

Bitcoin ETF is making Bitcoin investment easier and more accessible. It allows investors to participate in the crypto market without needing to handle Bitcoin directly. While there are risks and fees involved, Bitcoin ETFs offer a convenient way to invest in cryptocurrency. As the market grows and regulations improve, Bitcoin ETFs could become a major part of the financial world.