Google Share Price: Latest Trends, Forecast & Investment Insights

GOOG stock chart showing current market trend

The Google share price is one of the most closely watched numbers in the stock market. As the parent company of Google, Alphabet Inc. has built a massive global presence through search, YouTube, Android, cloud services, and AI.

Table of Contents

-

Introduction to Google Share Price

-

Alphabet Inc. (GOOG & GOOGL): A Quick Overview

-

Current Google Share Price Trends

-

Google Stock Forecast & Analysis

-

GOOG vs GOOGL: What’s the Difference?

-

Should You Invest in Google Stock?

-

Google Earnings Report Highlights

-

FAQs on Google Share Price

-

Conclusion

Alphabet Inc. logo beside rising share price graph

🟢 Introduction to Google Share Price

Google share price is a hot topic for both casual investors and seasoned traders. Alphabet Inc., Google’s parent company, has two main stock types – GOOG and GOOGL. If you’re looking to understand their stock performance, forecast, and whether it’s a smart investment, you’re in the right place.

Investors are always interested in how the stock performs, and for good reason—Alphabet consistently delivers strong earnings and innovative products. Whether you’re tracking GOOG or GOOGL, both offer solid long-term potential, with minimal difference in performance. Over the past few years, the Google share price has shown strong resilience even during market fluctuations.

Analysts often consider it a “Buy” due to its stable revenue streams and future growth potential. For those looking to invest in tech, Google remains a favorite pick. It’s not just a stock—it’s part of a digital empire. Keeping an eye on its share price helps investors make smart, informed decisions in a fast-moving tech world.

📊 Alphabet Inc. (GOOG & GOOGL): A Quick Overview

Alphabet Inc. owns Google, YouTube, Android, and several other massive platforms. It trades under the ticker symbols GOOG and GOOGL on the NASDAQ. These stocks represent one of the most valuable tech companies globally, making the Google share price important for market watchers.

Google headquarters representing its financial power

📈 Current Google Share Price Trends

As of the latest data, the Google share price has shown steady growth backed by strong revenue and innovation. It remains a top pick in many portfolios, supported by its consistent performance in search, ads, and cloud services.

🔮 Google Stock Forecast & Analysis

Experts predict continued growth for Alphabet’s stock, given their dominance in digital advertising and AI advancements. The average GOOGL share value is expected to rise steadily over the next 12 months, based on recent analyst ratings.

Check out in-depth analysis at MarketWatch (DoFollow).

🔍 GOOG vs GOOGL: What’s the Difference?

Both represent shares in Alphabet Inc. The key difference?

-

GOOG: Class C, no voting rights

-

GOOGL: Class A, comes with voting rights

Despite the difference, both usually follow the same price trend and are considered great long-term assets.

💰 Should You Invest in Google Stock?

With strong fundamentals, a diverse portfolio, and consistent growth, investing in Google can be a smart long-term decision. However, always review the latest Google stock analysis before buying.

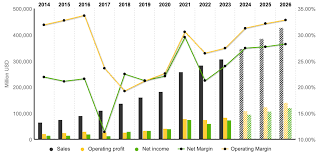

📄 Google Earnings Report Highlights

Recent Alphabet earnings reports revealed strong ad revenue and Google Cloud growth. These are major factors influencing the Google share price today.

Want the latest earnings summary? View it on Alphabet Investor Relations.

❓ FAQs on Google Share Price

Q: What is Google’s current market cap?

A: Over $1.5 trillion, placing it among the world’s most valuable firms.

Q: Does Google offer dividends?

A: Currently, no. It reinvests profits to fuel innovation and growth.

Q: Is Google stock a good long-term investment?

A: Analysts generally rate it as a “Buy” due to strong earnings and future potential.

✅ Conclusion

Whether you’re a first-time investor or looking to diversify your portfolio, keeping an eye on the is essential. With consistent earnings, innovative projects, and global influence, Google stock continues to be a solid investment choice.